Fast & Flexible Business Financing

Unlock Your Cash Flow. Fuel Your Growth.

Access quick financing through Karncy’s invoice discounting solution.

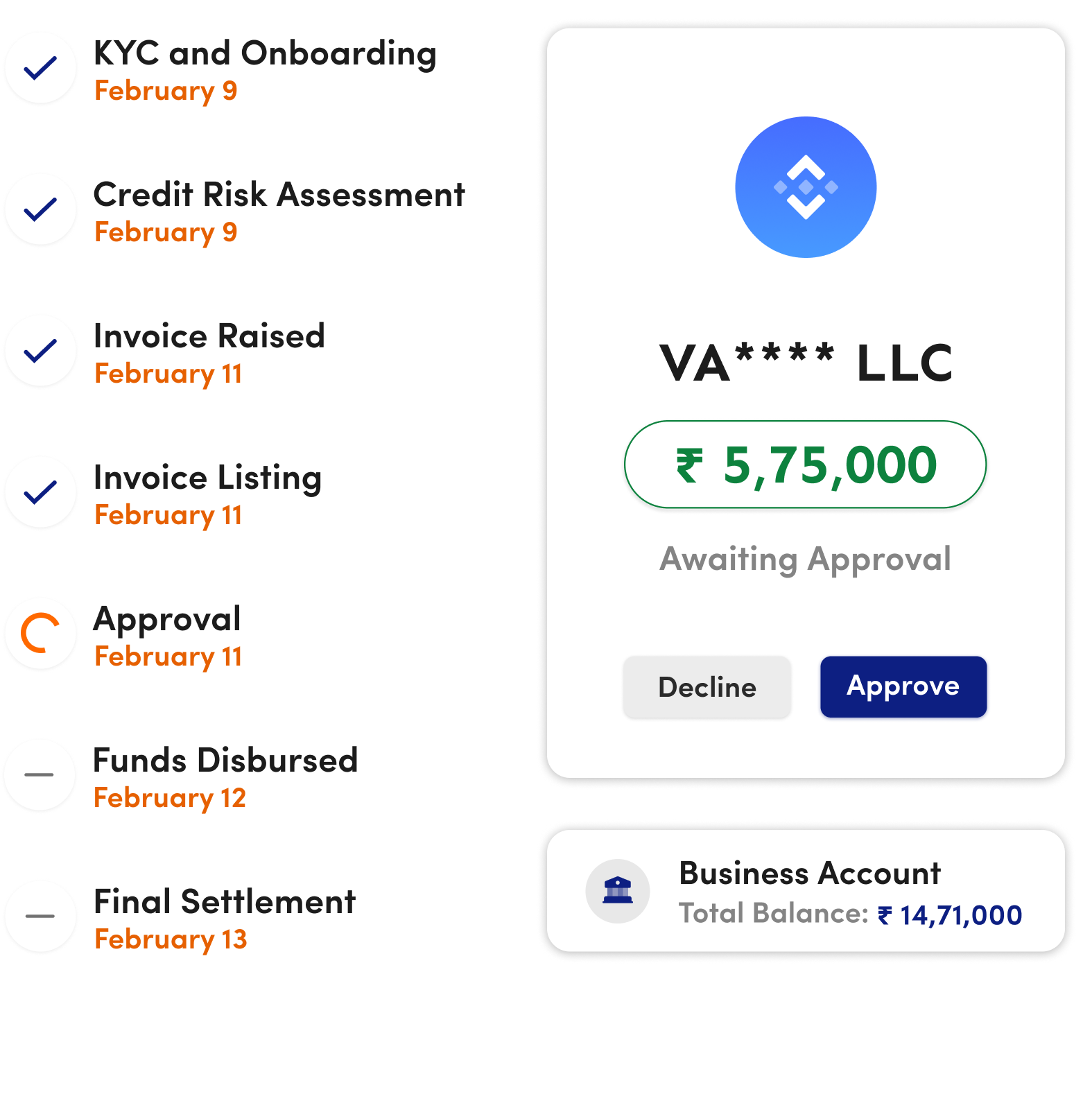

How it works

Access Quick Financing in Three Simple Steps

01

Submit Your Unpaid Invoices your bank

Upload your outstanding invoices to the Karncy platform. Our system automatically assesses them based on credibility and payment history. No need to wait weeks or months for your customers to pay and you get access to funds right when you need them.

02

Get Matched with Investors

Once your invoices are submitted, our network of investors reviews and funds them. This process ensures you receive the best possible financing terms. Our platform is fully transparent, allowing you to track the funding status in real-time.

03

Receive Funds and Boost Your Cash Flow

As soon as your invoices are funded, the money is transferred to your account within 0-24 hours. Use these funds to manage day-to-day operations, cover payroll, invest in growth, or meet any urgent business expenses and without taking on long-term debt.

Who Can Benefit from Karncy’s Financing?

Karncy’s invoice discounting is designed for businesses across various industries, helping them improve cash flow and grow faster.

Small & Medium Enterprises

Avoid cash flow gaps and keep operations running without waiting for client payments.

Service Providers & Agencies

Get paid for completed projects instantly instead of waiting for long payment cycles.

Retail & Wholesale Businesses

Manage inventory better by unlocking funds tied up in pending invoices.

Manufacturers & Suppliers

Keep production uninterrupted by converting unpaid invoices into immediate working capital.

Logistics & Transport Companies

Cover fuel, maintenance, and operational costs without relying on delayed payments.

IT & Software Firms

Ensure smooth payroll and project execution by accessing fast invoice financing.

Get started today

Sign up, submit your unpaid invoices, and receive funds fast. Keep your business moving forward with Karncy’s smart financing!